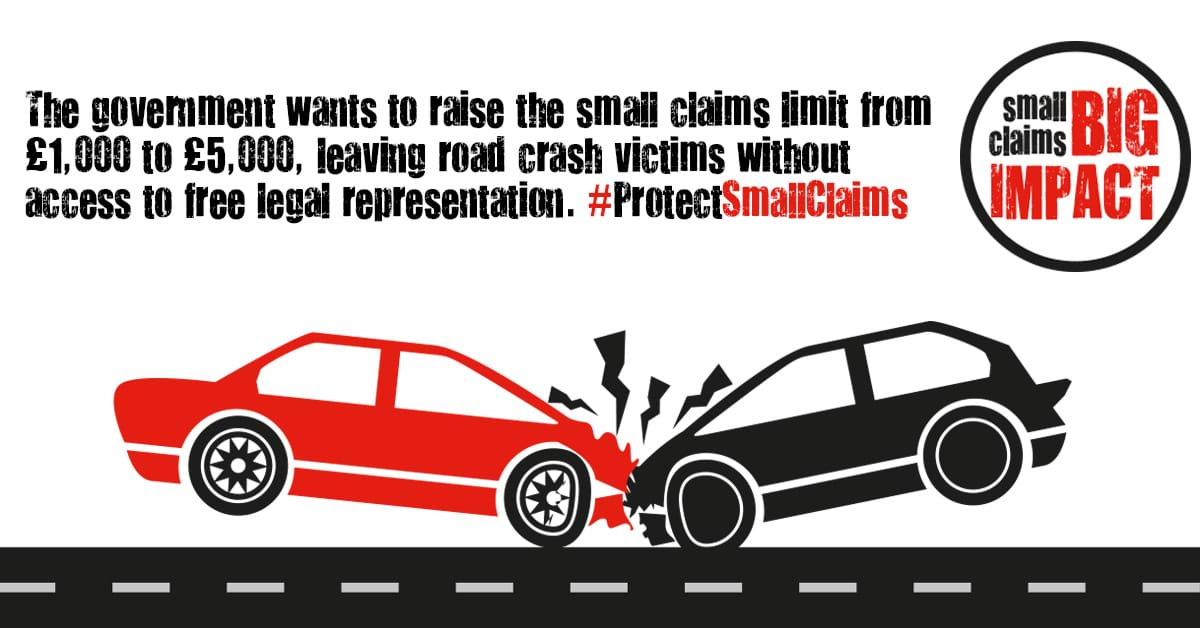

Standing up for consumers’ right to legal representation

The Chancellor announced in the autumn statement (Wednesday 25 November 2015) plans to limit access to representation and compensation for people injured in road accidents by increasing the small claims limit from £1,000 to £5,000.