Notes

Direct Line

In the first 9 months of 2013, Direct Line made an operating profit of £418m, a 20.1% increase on the same period last years (£348m). In its annual accounts, Direct Line gives a separate figure for operating profit from UK motor insurance. In 2012, this was £262m, a 3% increase on 2011 (£255m).

Admiral

In the first half of 2013, the second largest car insurer saw its profits from the UK market increase 5% to £192.7 million (H1 2012: £183.3 million). This follows a bumper year in 2012 when its profit from the UK car insurance rose 19% to £373m (2011: £314m).

AVIVA

The third largest car insurer does not divulge its profits from selling motor insurance, despite - like Direct Line and Admiral - being listed on the London Stock Exchange. Its 2012 annual report did, however, say that it had increased the number of motor insurance policies sold by 250,000 to nearly 2.5 customers. It also said the group had generated £448m in operating profit from selling general insurance in the UK, which included ‘good profitability in personal lines’ (motor and homeowner insurance). International Financial Reporting Standards (IFRS) require public companies to report separately on an operating segment that contributes 10% or more to overall reported profit. Given that AVIVA achieved a better ‘combined operating ratio’ for motor insurance than Direct Line (97% versus 101.6%) – albeit on a smaller customer base – it seems very likely that UK motor insurance on its own accounted for more than 10% of AVIVA’s 2012 operating profit of £1.888 billion.

AXA

The French-headquartered insurance group, which is listed on the Paris Bourse, does not give separate profit figures for UK motor insurance. However, AXA UK & Ireland did issue a press release on 21st February 2013 saying: “Motor profitability improved in 2012.”

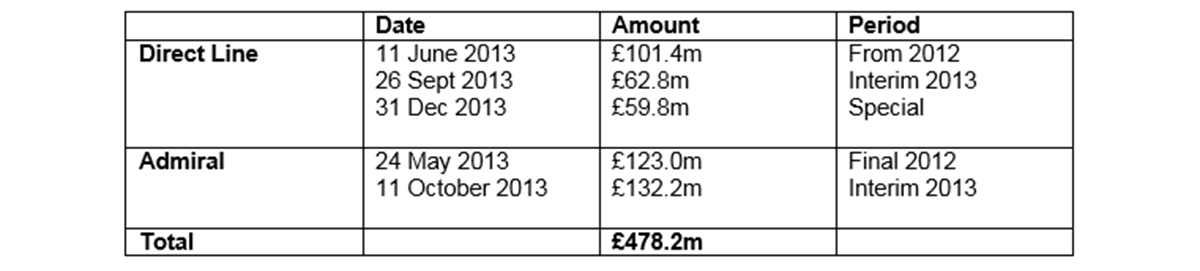

Dividends paid this year:

Injured on the roads? Help and compensation is close at hand.

If you’ve been injured on the roads in the last three years, Thompsons Solicitors' expert road traffic accident solicitors can support you with making a road traffic compensation claim.

Whether you were the driver or passenger in a car, lorry, coach, van, bus, truck, on public transport or were injured as a pedestrian or cyclist, you may be able to claim for damages.

If you have suffered injuries such as whiplash, bruising or a more serious injury following a road traffic collision on the motorway, country lane or city roads, our solicitors across the UK are ready to help you to make a claim and access any rehabilitation you require.

Unlike other firms, Thompsons only ever acts for the injured person – never for insurance companies. This means we will fight harder to secure the maximum level of compensation for your injuries, and don’t need to please motor insurance paymasters.

Contact us today for a free, no obligation assessment of whether you have a claim for compensation following a road accident.

For further information, visit our How to Make A Compensation Claim page.