Thompsons Solicitors has found the net cost of car insurance claims is decreasing, showing that there is no such thing as a crisis in compensation

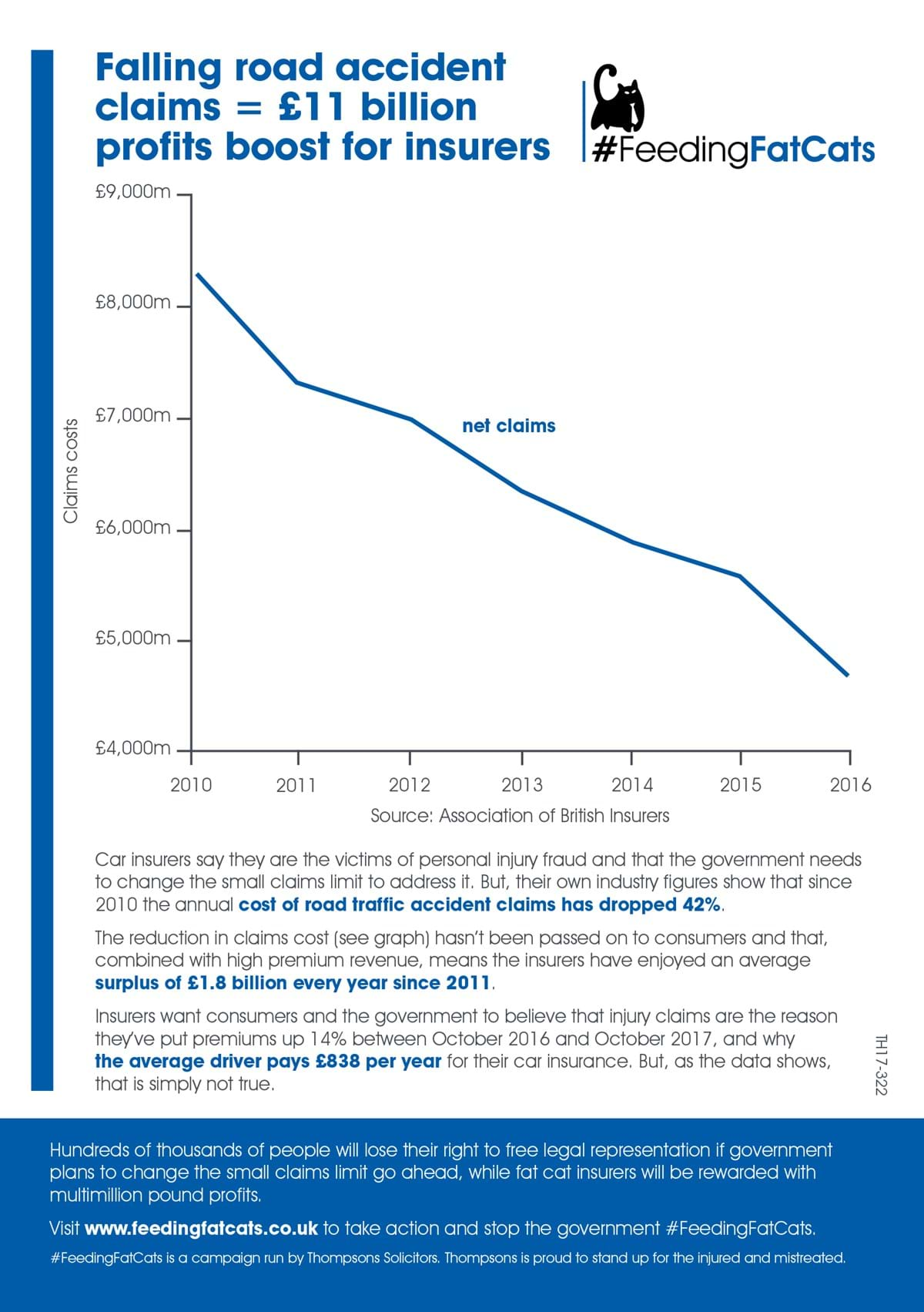

On the day of today’s ABI conference (Tuesday 27 February), Thompsons Solicitors has analysed data issued by insurers and has found that the net cost of car insurance claims incurred decreased in 2016 for the sixth year in a row.

The figures show a 42% drop compared to 2010, which contradict the insurers’ own assertion of a ‘compensation culture’ which they have used to lobby the government for changes to the law around injury claims, including workplace accidents.

The government proposed legislation in 2016 to increase the small claims limit from £1,000 to £5,000 for road traffic accidents, and to £2,000 for workplace accidents, which means the majority of injury victims would no longer have access to free or affordable legal representation.

Our head of policy, Tom Jones, says that the data proves that insurance companies are deliberately attempting to mislead the public on a supposed ‘crisis’ in car insurance claims in order to boost their own profits.

Injured on the roads? Help and compensation is close at hand.

If you’ve been injured on the roads in the last three years, Thompsons Solicitors' expert road traffic accident solicitors can support you with making a road traffic compensation claim.

Whether you were the driver or passenger in a car, lorry, coach, van, bus, truck, on public transport or were injured as a pedestrian or cyclist, you may be able to claim for damages.

If you have suffered injuries such as whiplash, bruising or a more serious injury following a road traffic collision on the motorway, country lane or city roads, our solicitors across the UK are ready to help you to make a claim and access any rehabilitation you require.

Unlike other firms, Thompsons only ever acts for the injured person – never for insurance companies. This means we will fight harder to secure the maximum level of compensation for your injuries, and don’t need to please motor insurance paymasters.

Contact us today for a free, no obligation assessment of whether you have a claim for compensation following a road accident.

For further information, visit our How to Make A Compensation Claim page.