Where’s the impact of the alleged “fraud” they talk so much about?

Motor insurance company share prices have bucked the downward trend in the FTSE 100 and the wider insurance sector by a staggering margin in the past year, despite constant complaints by insurers that they are suffering from high levels of fraud.

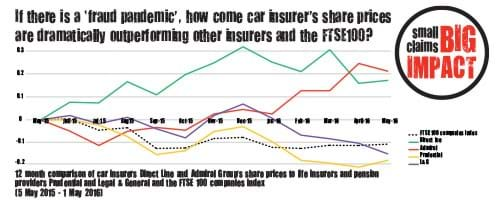

Data analysis conducted by Thompsons Solicitors shows that the share prices of UK-based car insurers Direct Line and Admiral have increased by 17% and 21% respectively since the general election in May 2015 (Direct Line’s share price has increased by 96% since it started trading in October, 2012; Admiral’s increased 75% in the same period).

These dramatic increases are inconsistent with the FTSE 100, which is down by 11% since the general election, and with other insurers like Prudential and Legal & General, who largely operate in life insurance and pensions and have both seen share price decreases in the last year.

Thompsons Solicitors says that these figures are at odds with industry claims that fraud is at record levels and that car insurers are victims of a ‘burgeoning’ fraud ‘pandemic’.

Thompsons has called on insurers to stop using the claim that there are high levels fraud as an argument to support the government’s proposals to increase the small claims limit for road accident victims.

An increase to the small claims limit would remove access to a free solicitor from road accident victims whose damages are valued at less than £5,000 – approximately 90% of such cases.

“Insurers have been putting out statement after statement complaining of a ‘fraud pandemic’ but these figures show that investors see car insurance as a very lucrative sector that delivers much better returns than other financial services or the wider FTSE 100,” said Tom Jones, head of policy at Thompsons Solicitors.

“Follow the money. The numbers don’t lie – the data proves that car insurers are doing very nicely thank you. If there really were huge levels of fraud car insurers would not be so popular with investors. Unlike the rest of the UK stock market, which has slumped since April 2015, share prices - and profits - for car insurers have gone up, at times hitting record levels.

“In this favourable market, you’d think car insurers would be satisfied, but instead, they are exaggerating fraud – using unverified figures - and pushing for a reduction in access to justice for all motorists in order to make even more money. Even on their own figures, 87% of motorists are honest, and from our experience it's far higher than that, yet they want everyone punished through increasing the small claims limit. It will push their already burgeoning share prices and profits even higher and leave the public with no legal protection at a time when they need it most.”

Thompsons Solicitors is opposing the change to the small claims limit in road accidents. To learn more visit our dedicated campaign or search ‘Small Claims Big Impact’.

Injured on the roads? Help and compensation is close at hand.

If you’ve been injured on the roads in the last three years, Thompsons Solicitors' expert road traffic accident solicitors can support you with making a road traffic compensation claim.

Whether you were the driver or passenger in a car, lorry, coach, van, bus, truck, on public transport or were injured as a pedestrian or cyclist, you may be able to claim for damages.

If you have suffered injuries such as whiplash, bruising or a more serious injury following a road traffic collision on the motorway, country lane or city roads, our solicitors across the UK are ready to help you to make a claim and access any rehabilitation you require.

Unlike other firms, Thompsons only ever acts for the injured person – never for insurance companies. This means we will fight harder to secure the maximum level of compensation for your injuries, and don’t need to please motor insurance paymasters.

Contact us today for a free, no obligation assessment of whether you have a claim for compensation following a road accident.

For further information, visit our How to Make A Compensation Claim page.